The Mortgage365 Suite

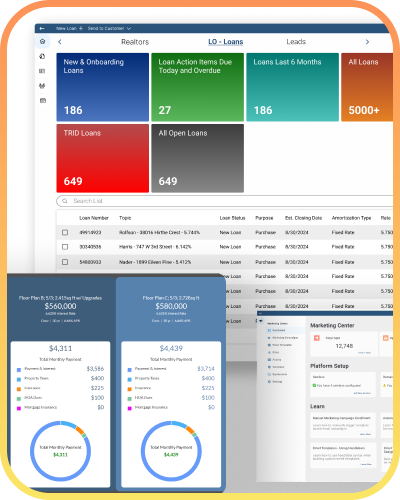

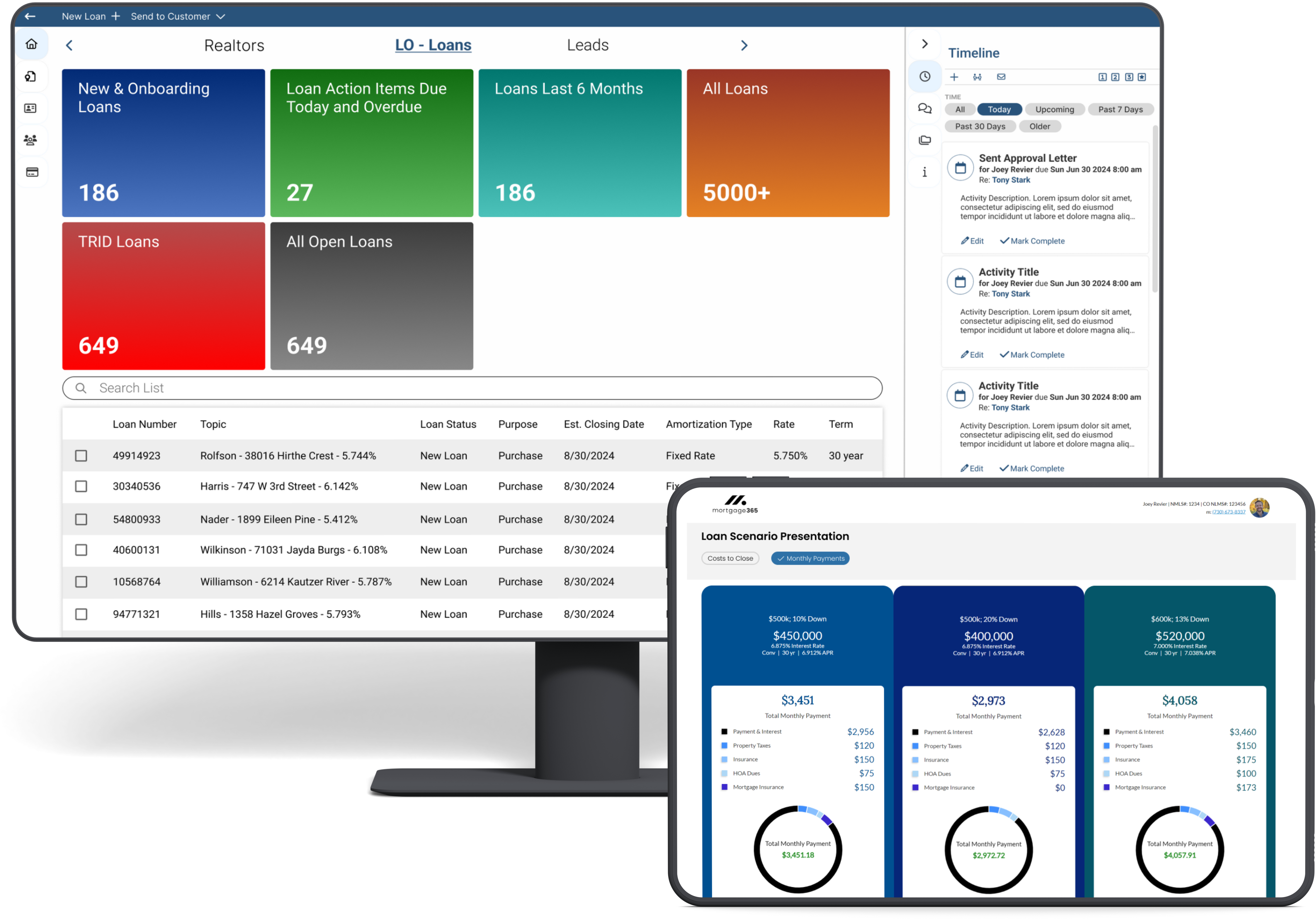

Horizon - Mortgage CRM & Work Surface

A CRM Built for Lending

Horizon gives loan officers and teams a daily workspace designed around mortgage production, not generic sales stages. Track every file in a clear pipeline, sync seamlessly with your LOS, and keep tasks, follow-ups, and borrower communication in one place. The result: less swivel-chair, more loans moving forward.

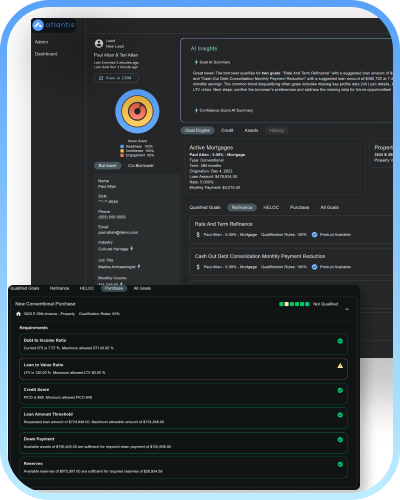

Atlantis - Mortgage Opportunity Engine

Spot Your Next Loan

Atlantis uncovers lending opportunities hidden inside your database and helps you prioritize outreach with three scores — Readiness, Confidence, and Engagement. With built-in data checks, profile enrichment, and clear outreach cues, your team knows exactly where to focus first. That means fewer wasted calls, stronger conversions, and more loans closed.

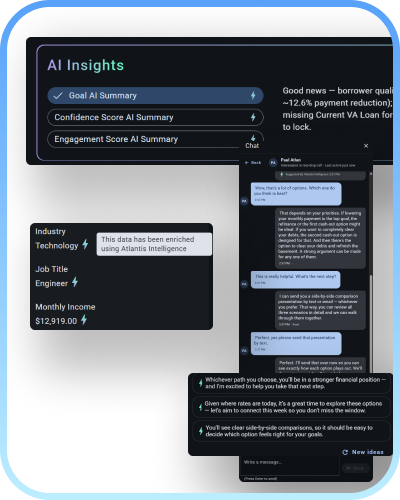

Agentic AI

Smarter Lending, Powered by AI

Atlantis uses AI to enrich borrower data and generate Readiness, Confidence, and Engagement scores, giving you a ranked list of the strongest opportunities. Plain-English context and timing suggestions help loan officers know where to focus and when, so they can prioritize outreach with confidence.

Integrations & Compliance

Fits Your Stack. Checks the Boxes.

Horizon connects to the systems lenders rely on — LOS, credit, pricing, telephony, e-sign, and more — so your team doesn’t have to juggle tools. Every action is backed by role-based permissions, audit trails, and field-level history, giving IT and compliance leaders confidence that growth doesn’t come at the expense of control.

Opportunity Intelligence

Atlantis: Surface Tomorrow's Loans Today

Stay Ahead of Competitors

Be first to adopt the next wave of AI innovation. While others rely on legacy tools, Atlantis puts you on the front lines of lending technology.

.png)

Bring in Net New Business

Uncover deals hiding in your portfolio and prioritize them with Readiness, Confidence, and Engagement scores. Your loan officers start every day with a shortlist of the best opportunities.

Grow Sustainably

Enrichment and transparent scoring give your team confidence to scale without risking service quality or borrower trust.

Mortgage CRM

Horizon: Built for the Way Lenders Work

Faster Lead-to-Close

Automations and LOS sync keep loans moving without bottlenecks or manual busywork.

-1.png)

Your Daily Command Center

Pipeline, tasks, borrower communication, and documents all live in one workspace your team actually wants to use.

-1.png)

Built by Loan Officers, for Loan Officers

Every workflow, task, and view is shaped by how loan officers actually work, making adoption natural and productivity effortless.

2.1 Million

+

Loans

Processed

5

>

Months to See

ROI

22

+

Technology

Integrations

90

>

Days to

Go-Live

What is Mortgage365?

Mortgage365 is a suite of mortgage-specific products - Horizon CRM & Atlantis Opportunity Engine - built for better lending.

How is Horizon different from other CRMs?

Horizon was built by loan officers, for loan officers — designed around how lending really works. With bidirectional LOS and system integrations, loan officers can manage pipelines, borrower communication, tasks, and documents all from one workspace. No more toggling between platforms; Horizon keeps everything in sync so teams can focus on moving loans forward.

Will Mortgage365 work with my existing tech stack?

Mortgage365 offers bidirectional integrations with 80% of mortgage technology platforms on the market today, and we are working hard to continue growing this number!

How does Mortgage365 use AI?

Atlantis applies agentic AI to enrich borrower data and generate Readiness, Confidence, and Engagement scores, helping you uncover new business and focus on the right opportunities first. It also runs borrower profiles against your product offerings, guiding loan officers toward the best-fit conversations to move deals forward.