CREDIT IMPROVEMENT TOOLS

Turn Credit Challenges into Homeownership Opportunities

Empower borrowers with credit difficulties to become homeowners with tools to help them stay on track to become qualified.

Pull Credit

Credit Score Insights at Your Fingertips

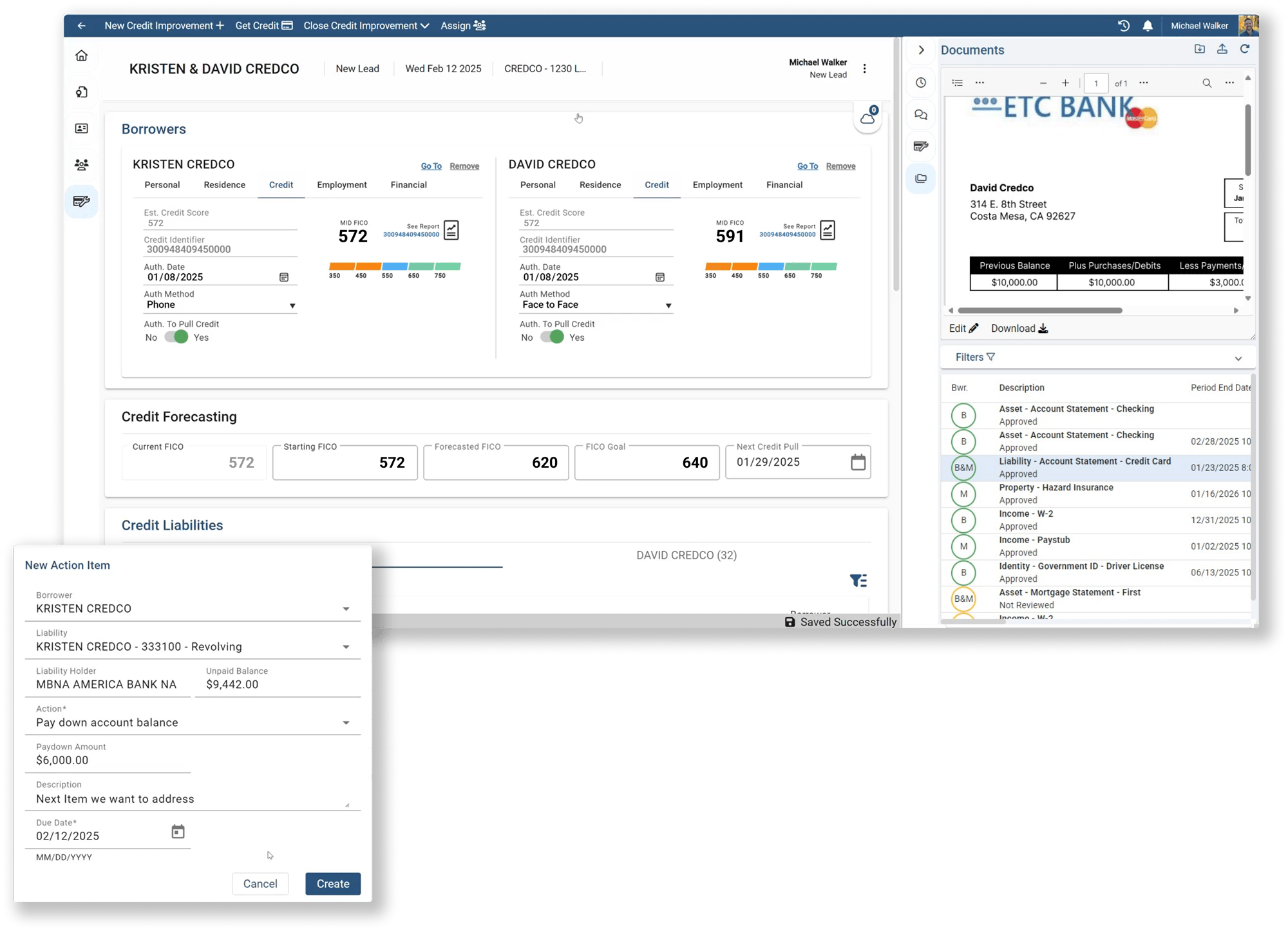

Effortlessly access the credit information you need via integrations with multiple credit providers. Pull hard and soft credit reports or reissue existing ones. and store the data within Mortgage365 so all users with proper permissions can stay aligned on progress - all in one streamlined workflow.

View Liabilities

Uncover Borrower Liabilities with Ease

Access and analyze a borrower's credit liabilities in a clear snapshot. After a credit pull, all liabilities are automatically loaded, providing a complete view of their financial obligations in seconds. This effortless approach to credit assessment helps credit improvement teams make faster, more informed decisions with confidence.

Credit Action Plans

Targeted Credit Action Plans to Transform Borrower Profiles

Create personalized action plans to address borrower liabilities and unlock their full credit potential. With tailored strategies, you can tackle financial obstacles and deliver meaningful improvements to credit scores. Empower borrowers to achieve their dream of home ownership.

Communicate Progress

Keep in Touch with Integrated Communication Tools

Easily stay in touch with borrowers about their progress and credit improvement journey using integrated SMS, Telephony, and Email features. These communication tools enable seamless, real-time conversations, ensuring borrowers are informed and engaged throughout the process.

Document Management

Organize and Access Documents with Ease

Easily upload, organize, and access documents to simplify the journey to improved credit. With automatic meta-tagging and quick file retrieval, managing borrower documents has never been more efficient.

Set Goals

Drive Results with Focused Goal Setting and Tracking

Help your credit improvement team and borrowers stay focused with strategic goal setting, regular progress tracking, and timely plan evaluations. Clear, measurable goals ensure tasks are completed on time, driving long-term credit success.