BANK SOLUTIONS

Streamline Your Mortgage Process.

Process Driven

Modern Solutions for Modern Banks

Data-Rich, Relationship Focused

Your Go-To Tool for the Entire Mortgage Process

Amplify Efficiency, Build Trust, and Expand on Your Success

Banks encounter distinct challenges when it comes to managing and offering mortgages, where efficiency, branding, and customer trust are critical. Mortgage365 offers a comprehensive solution tailored to optimize your processes, foster customer relationships, and drive growth. Discover how our platform can transform your bank’s mortgage operations.

Efficiency Focused

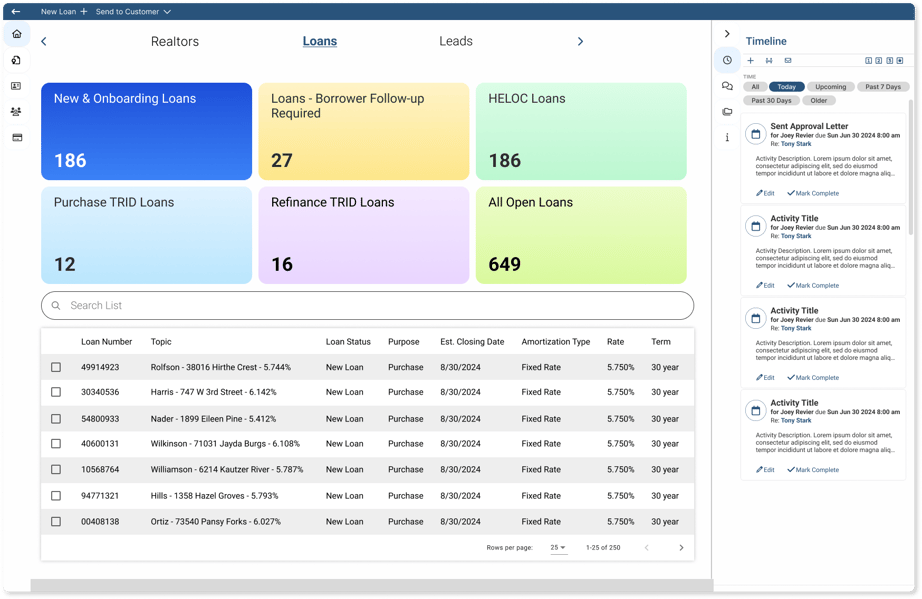

Save Time, Grow Relationships, Do More with Less.

Bank lending teams often juggle multiple relationships with the borrower, which is why implementing efficient processes is paramount to success. Mortgage365 saves you time by providing all the tools you need to manage a mortgage from lead to close in one single platform.

Automated Operations

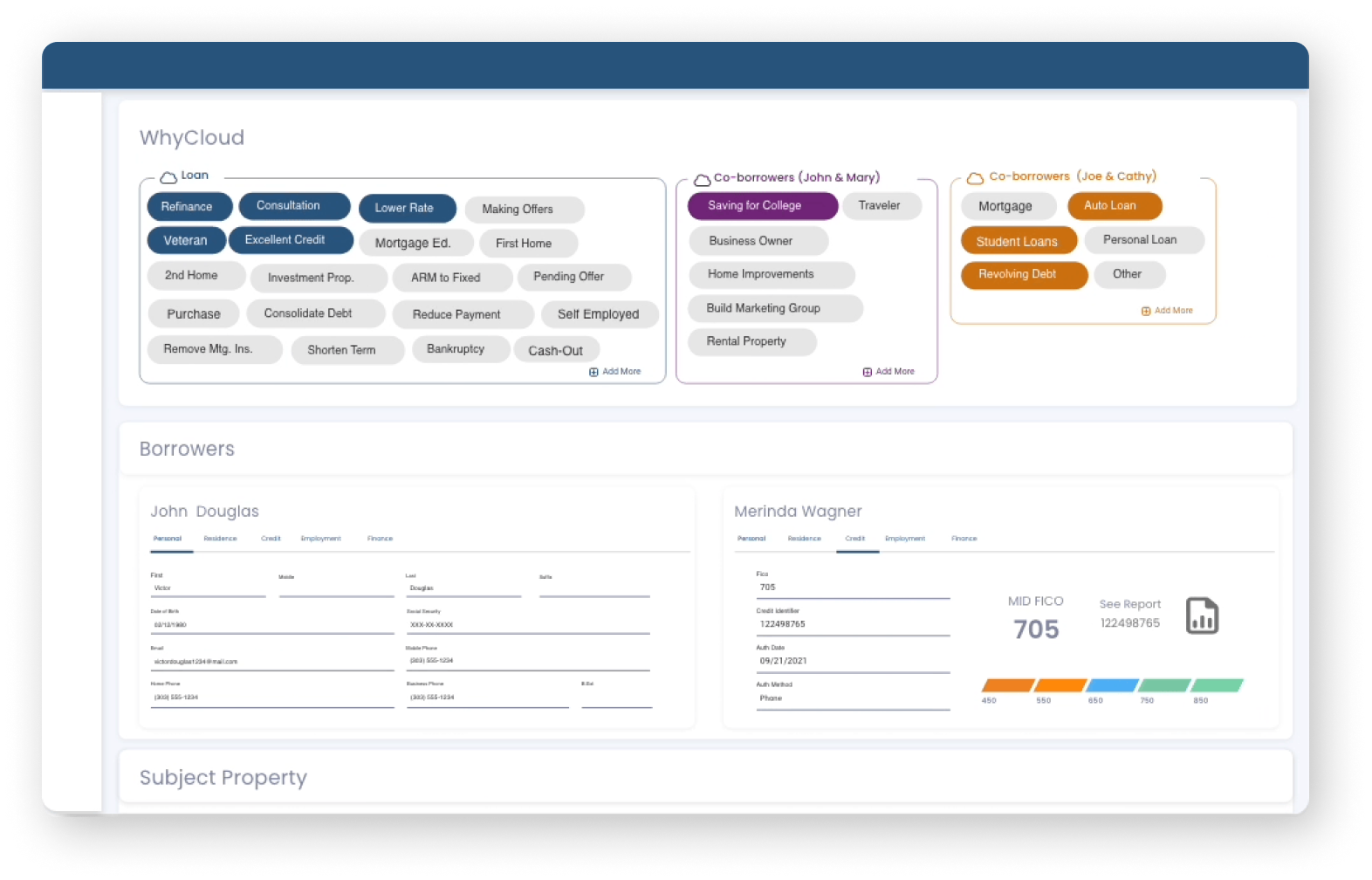

Give Your Mortgage Department a Modern Makeover.

Your time is valuable, which is why Mortgage365 has worked to automate the monotonous steps of the process. By automating processes like outreach, pre-approvals, and distributing data between existing technology, you now have more time in your day to focus on what you do best; building and managing relationships.

Grow Market Share

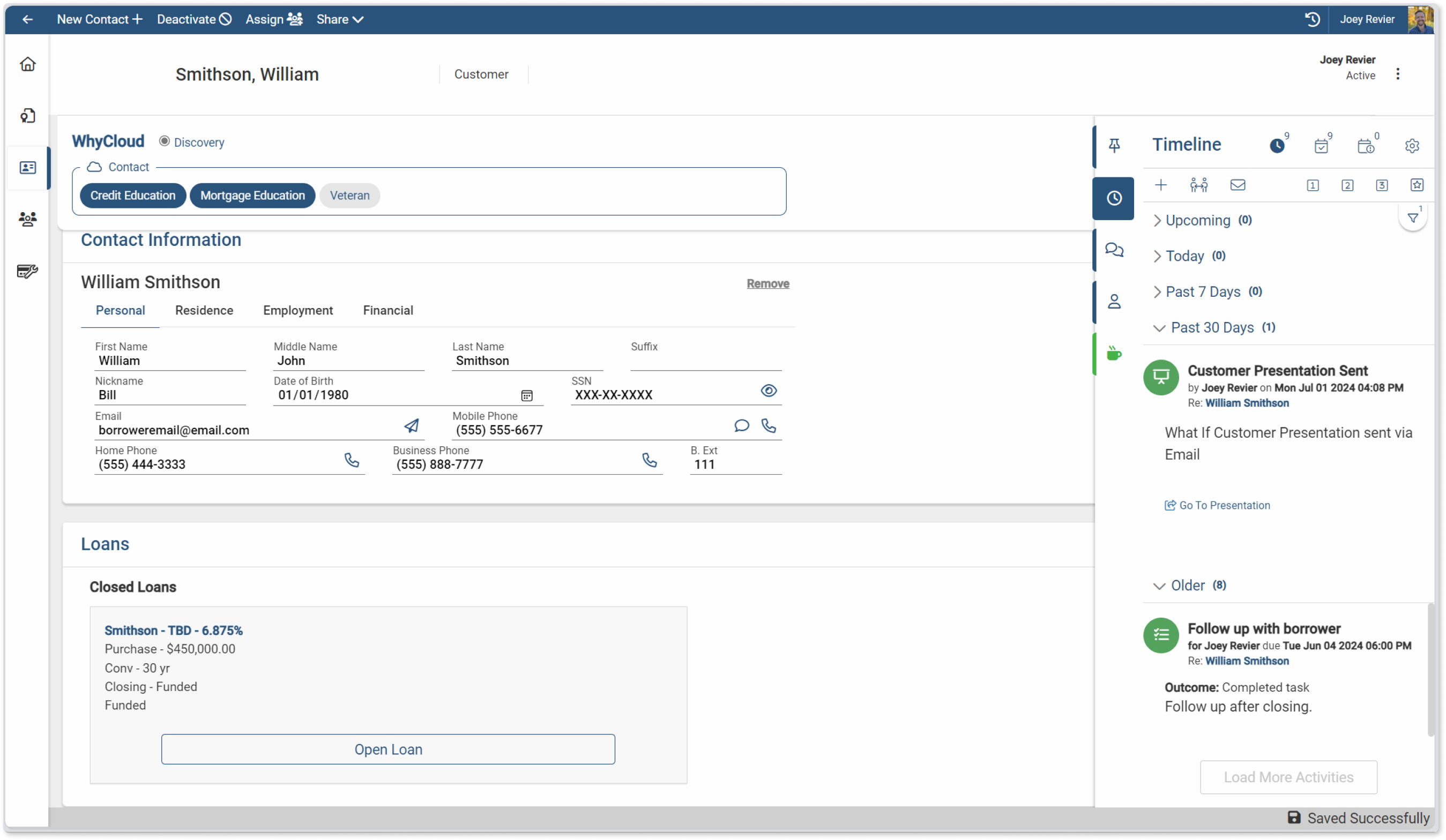

Offer Better Service Than Your Competition.

Relationships are at the center of banking operations. Mortgage365 helps you get in touch and stay in touch with your customers to give them the best mortgage experience and ensure no opportunity falls through the cracks. Our system was built to help you stay in touch 24 hours a day, 7 days a week.

.png)

Why Mortgage365?

Easy Implementation

On average, it takes about 90 days to fully implement Mortgage365.

Integrated Security

We’ve partnered with Microsoft to maintain the most comprehensive set of compliance offering of any cloud service provider.

Dozens of Integrations

We offer integrations with the tools and technologies that you already use and depend on so you don’t have to skip a beat.