Your One-Stop Mortgage Shop

.gif)

Lead

Lead Management Made Simple

You put the borrower at the forefront of every move and decision you make, so why shouldn’t your technology do the same? Mortgage365 allows you to fully nurture every lead by giving you the insights you need to provide them with a fully personalized and top-tier experience. Never leave an opportunity behind with tools like:

- WhyCloud Tagging to gain a comprehensive understanding of your leads from a glance.

- Omnichannel Communication to stay in touch with potential borrowers.

- Fully Customizable Lead Workflows to do what you need them to do, when you need them to do it.

- Bidirectional Sync with your marketing tools so you can continue to utilize all the tools you depend on and trust.

Loan

Become a Mortgage Rock Star

Modern mortgage isn’t just for your borrowers, it’s for you too. Mortgage365 partners with top providers in the space so we can provide you with tools like:

- Custom Loan Scenarios that you can build out in minutes.

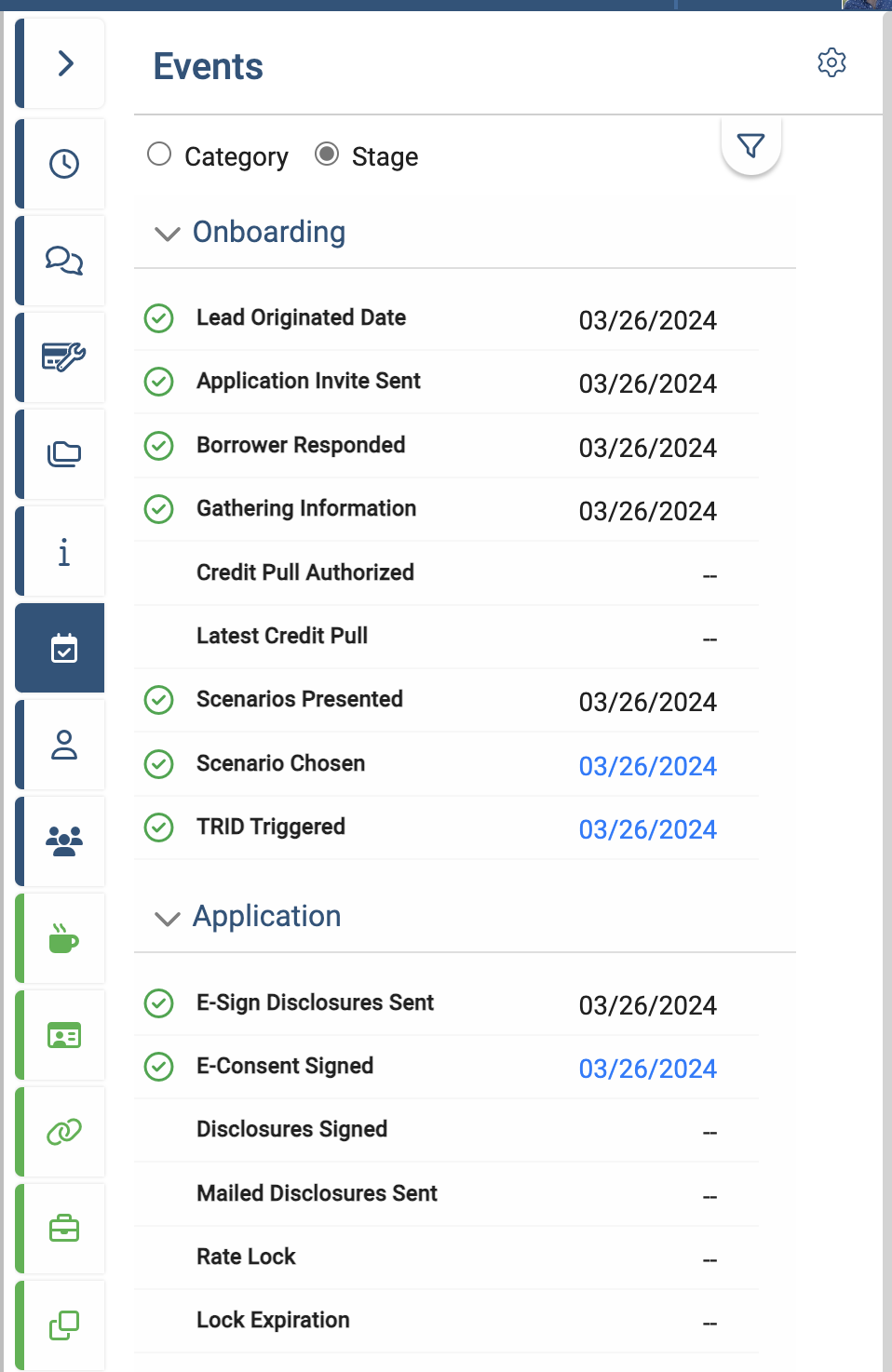

- Timeline Activities to view all the milestones and communications related to any loan.

- Bi-Directional Integrations to ensure that any status changes are instantly reflected within Mortgage365 in real-time.

- Cross-team access to streamline internal communication and workflows.

- Activity Center to gain a complete view of your loans in process, automate task generation, and streamline your workday to save you more time.

Pipeline

Pipeline Management in the Palm of Your Hand

It can be challenging to juggle multiple loans in different stages of the mortgage journey. Mortgage365 revolutionizes pipeline management for loan officers by offering solutions such as:

- Forecasted Closing provides predictive insights into when loans are likely to close, enabling lenders to prioritize their workload efficiently, and helps you set proper borrower expectations.

- Bi-Directional Integration with your LOS so you can manage your pipeline without actually entering your LOS.

Retention

Cultivate Long-Term Borrower Relationships

The best customers are the ones you’ve already worked with. Mortgage365 helps you keep track of potential opportunities post-close to help you keep your deal pipeline full. Our retention features include:

- WhyCloud Tags to help remind you of your borrower's goals present, and future.

- Complete Borrower History is stored within Mortgage365 forever, so no information is forgotten.

.gif)

Features You Love Without Complicated Tech

Simple UI & UX

Mortgage365 is easy to learn and navigate.

Easy Implementation

On average, it takes about 90 days to fully implement Mortgage365.

Built on Microsoft

Developed for the Microsoft technologies you already use and trust.

Highly Configurable

Mortgage365 offers out of the box solutions that are configured to your specific needs.

Integrated Security

We've partnered with Microsoft to maintain the most comprehensive set of compliance offerings of any cloud service provider.

Dozens of Integrations

We offer integrations with the tools and technologies you already use and depend on so you don't have to skip a beat.